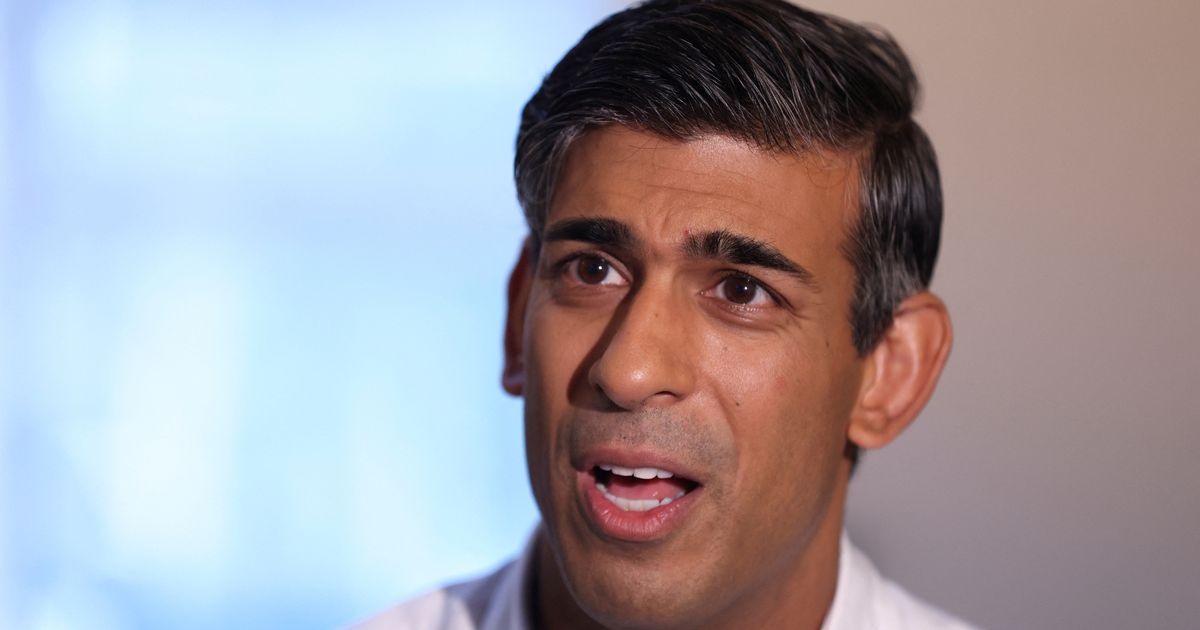

Sunak needs to go in the opposite direction: extend inheritance tax to the super wealthy, who typically hide their assets offshore and in trusts in order to avoid inheritance tax (amongst others). About 4% of people pay inheritance tax: essentially the top 2-5%. The 1% don’t pay any.

Sunak needs to go in the opposite direction: extend inheritance tax to the super wealthy, who typically hide their assets offshore and in trusts in order to avoid inheritance tax (amongst others).

You’ve just described his family.

Yep. I kind of wish that having those kind of tax arrangements automatically disqualified someone from being a politician. Not paying UK tax? You can’t be part of the UK’s government. Won’t happen, though.

How does money get “off shore” in the first place?

Can’t they implement stupid taxes on any money leaving the country? Like 25-50% or something?

We had money controls in the 70s but it basically led to poor inward investment and expats waiting for a change of government before coming back to the UK. Why move capital into a country you’re not sure you can take it out afterwards.

You have to be claiming

£1M£500k before you start paying inheritance tax for a direct family member. Remembering most of the time any value that is bequeathed is shared, it is easy to see why only 5% pay inheritance tax. There will be a lot more above those who simply dodge it by going offshore. Restrictions need tightening on inheritance tax not removing imo. Offshoring property needs to be banned outright.EDIT amount was wrong. It is £1m that you can claim if you are married. £500k for direct family and £375k for everyone else.

The threshold for inheritance tax in the UK is £325,000.